Tax Exempt & Government Entities

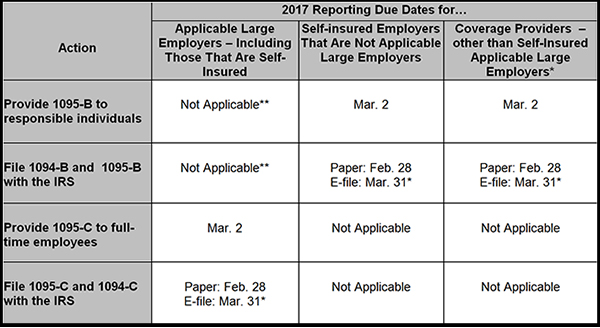

The IRS extended the 2017 due date for employers and coverage providers to furnish information statements to individuals. The due dates to file those returns with the IRS are not extended. This chart can help you understand the upcoming deadlines.

* If you file 250 or more Forms 1095-B or Forms 1095-C, you must electronically file them with the IRS. Electronically filing ACA information returns requires an application process separate from other electronic filing systems. Additional information about electronic filing of ACA Information Returns is on the Affordable Care Act Information Reporting (AIR) Program page on IRS.gov and in Publications 5164 and 5165.

** Applicable large employers that provide employer-sponsored self-insured health coverage to non-employees may use either Forms 1095-B or Form 1095-C to report coverage for those individuals and other family members.

This chart applies only for reporting in 2017 for coverage in 2016.

See IRS Notice 2016-70 for more information.