Each year, the IRS publishes standard mileage rates that taxpayers may use to substantiate expense reimbursements for employee travel, compute deductible costs associated with certain transportation expenses, and other purposes. Taxpayers are not required to use the standard mileage rates, although many organizations choose to do so in lieu of substantiating and computing actual deductible amounts.

The standard mileage rates are published annually by the IRS and are generally announced before the beginning of the year in which they apply. However, on June 9, 2022, the IRS published a mid-year increase to the standard mileage rates effective for expenses paid or incurred from July 1, 2022, through December 31, 2022.

The IRS Commissioner indicated that the adjustments were made to better reflect the recent increase in fuel prices. In addition to fuel costs, other automobile expenses such as depreciation and insurance are included in the calculation of the standard mileage rates.

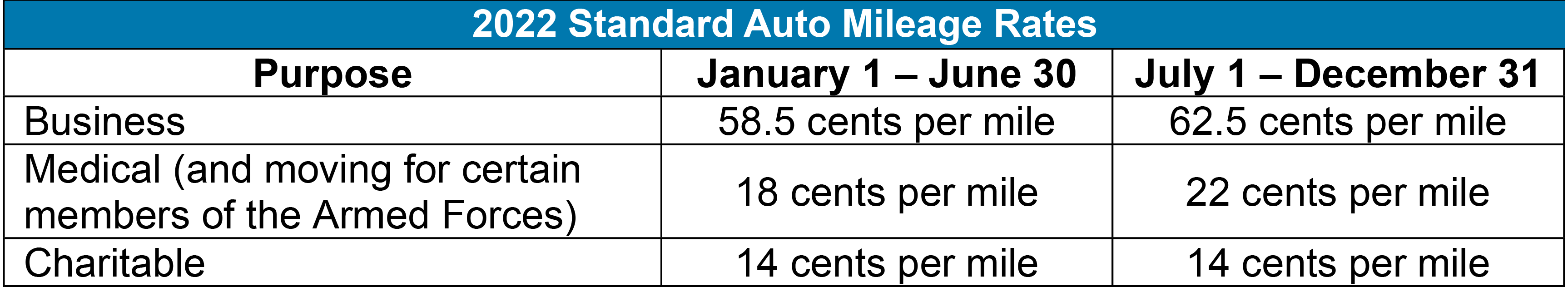

The chart below reflects the standard mileage rates for various types of travel expenses during 2022:

As outlined in the chart above, the 14 cents per mile rate for charitable travel remains unchanged as it is set by statute.

Organizations using the optional standard mileage rates should plan to use the updated rates beginning on July 1, 2022.