BMWL National Nonprofit Conference

Batts Morrison Wales & Lee is pleased to announce that registration is now open for the BMWL National Nonprofit Conference. Join hundreds of nonprofit leaders from across the country for this live, online event on Tuesday, August 27, 2024, from 8:20 a.m. until 4:30 p.m. Eastern.

Broadcasting live from Orlando, Florida to nonprofit leaders across the US, this full day of learning will be packed with relevant, up-to-the-minute information that will empower you to effectively address many of the latest tax, financial, and regulatory developments impacting the nonprofit sector.

Join nonprofit leaders from across the country

One of the top-ranked conferences in the US by a leading nonprofit publishing organization

Full day of Continuing Education opportunities

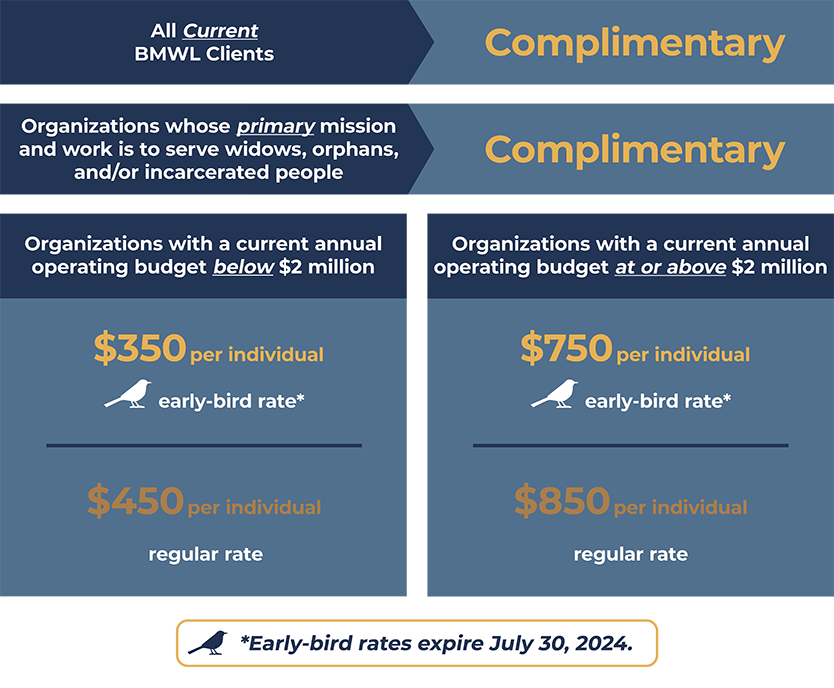

BMWL is introducing a brand new pricing structure for the 2024 Conference. Please refer to the pricing chart below before registering to ensure you are selecting the right category.

Please click the button below to request your invitation for the 2024 BMWL National Nonprofit Conference.

If you need further assistance, please reach out to our team at [email protected].

Session Presenter: Mike Batts

An executive briefing by Mike Batts of recent and trending tax, regulatory, and Capitol Hill developments relevant to nonprofit leaders. Specific topics include, but are not limited to:

• 2024 Election Impact: Major Tax Provisions Relevant to Nonprofits Scheduled to Expire in 2025

• A New Opportunity for Clergy to Elect Back in to Social Security?

• The Johnson Amendment – New Developments

• Court Says Exempt Status ≠ Federal Financial Assistance

• The Corporate Transparency Act – Relevant to Nonprofits?

• Update on SECURE 2.0 Act Provisions

• Update on Energy-Related Tax Benefits for Nonprofits

• IRS Guidance on Group Exemptions – What Happened?

• Establishing the Rebuttable Presumption of Reasonableness in Executive Compensation and Related Party Transactions

• Banking Safety

• New Proposed ECFA Leadership Standard

• States and E-Verify

• States and New Hire Reporting

• And more!

Session Presenters: Michele Wales & Kaylyn Varnum

The IRS will soon begin one of the largest tax compliance examination initiatives in history as it seeks to recover some of the billions of dollars in invalid and improper claims for the Employee Retention Credit (ERC). Top leaders of the BMWL tax team will discuss how the IRS is likely to pursue such examinations, what kinds of documentation IRS agents will be requesting, and how the IRS is likely to navigate ERC examinations of churches.

Session Presenters: Michael Batts, Jr. & Roman Kepczyk

This session will consist exclusively of practical guidance on how you (yes, you) can greatly reduce your risk of becoming a cyber fraud victim. Our highly experienced presenters will explain in practical terms what you can and should do…and what you should not do…to reduce your risk. As a bonus, this 30-minute session will be provided to all attendees as a recorded video along with limited permission to share it with your organization’s staff…to help them reduce their risk as well!

Session Presenters: Dustin Gaines & Donn Meindertsma

Nationally known employment law attorneys will address hot topics in the area of employment law affecting nonprofit organizations…and there are some big ones! The discussion will include new overtime pay rules, new guidance on noncompete agreements, recent guidance on employee severance agreements, and more.

Session Presenter: Paul Winters

Artificial intelligence (AI) tools continue to emerge and expand, and they offer unique new capabilities that can improve productivity in the workplace. Attorney Paul Winters will brief attendees on important legal considerations associated with using AI tools in the workplace. As a bonus, you will receive a sample policy for the use of AI in the workplace as an educational resource to aid you in addressing the topic in your own organization. Additionally, Paul will provide a brief update and resources on data privacy laws relevant for nonprofit organizations.

Session Presenters: Kaylyn Varnum & Sophie Chevalier

In this session, senior members of the BMWL tax team will address common examples of revenue-generating and investment activities that result in unrelated business taxable income as well as important compliance considerations associated with such activities.

Session Presenters: Danny Johnson & Steve Cardwell

Senior members of BMWL’s audit and assurance team will discuss healthy liquidity for nonprofit organizations, including metrics that work for evaluating the financial health of almost any type of operating nonprofit organization. They will also address healthy uses of debt, negotiation of key debt terms, and metrics for evaluating safe levels of long-term debt.

Session Presenters: Mike Lee, Dale Houser, & Michele Wales

Nonprofit leaders are often unaware of the latitude available in drafting their organization’s audited financial statements. Accounting standards allow for flexibility in many areas, including formatting, what is and is not included, and expense allocations. Top leaders of the BMWL audit and assurance team will describe how organizations can put their best foot forward in their financial statements while complying with appropriate standards. As a bonus, the national director of BMWL's tax practice will provide brief commentary about similar considerations when preparing Form 990.

This year’s presenters are at the forefront of developments affecting nonprofits and will address the topics nonprofit leaders need to know about right now, including trending tax and regulatory developments.

Mike Batts

Managing Partner, BMWL

Michael Batts, Jr.

Director of Systems, BMWL

Steve Cardwell

Senior Manager – Audit & Assurance Services, BMWL

Sophie Chevalier

Senior Manager – Tax Services, BMWL

Dustin Gaines

Partner, Gaines, Goodspeed & Juba, P.C./My Church Law Firm

Dale Houser

Assistant National Director – Audit & Assurance Services, BMWL

Danny Johnson

Assistant National Director – Quality Assurance, BMWL

Roman Kepczyk

Director of Firm Technology Strategy, Rightworks

Mike Lee

National Director – Audit & Assurance Services, BMWL

Donn Meindertsma

Partner, Conner & Winters

Kaylyn Varnum

Assistant National Director – Tax Services, BMWL

Michele Wales

National Director – Tax Services, BMWL

Paul Winters

Partner, Wagenmaker & Oberly

See the brochure below for complete Conference information, including topics, presenters, registration fees, and continuing education opportunities.

If you are a nonprofit leader who is looking to gain invaluable awareness of recent developments in the nonprofit sector and actionable strategies to employ in your organization, you should participate in this one-of-a-kind virtual event on August 27, 2024. Click the button below to request your invitation for the BMWL National Nonprofit Conference today.

If you have questions or need further assistance, please reach out to [email protected] so that we can assist you.