If your organization produces external financial statements following generally accepted accounting principles (“GAAP”), you are probably aware that the biggest change in nonprofit financial reporting in the last 20 years is upon us. Accounting Standards Update (“ASU”) 2016-14, Presentation of Financial Statements of Not-for-Profit Entities, was issued by the Financial Accounting Standards Board (“the FASB”) in 2016 and is effective for annual financial statements issued for fiscal years beginning after December 15, 2017 (i.e., calendar years ending December 31, 2018 and non-calendar years ending in 2019).

ASU 2016-14 (“the ASU”) is intended to improve, but not overhaul, the financial reporting model for nonprofit organizations. This article provides an overview of the ASU’s key elements of change, and contains a more in-depth discussion about the new required disclosures regarding liquidity and availability of resources.

The Key Elements of Change in the New Pronouncement

Following is a brief summary of the five most significant changes required by the ASU.

Classifications of net assets

Organizations will present amounts for two classes of net assets rather than the currently required three classes. The two classes are net assets without donor restrictions and net assets with donor restrictions. Enhanced disclosures regarding governing board designations and similar actions that result in self‐imposed limits on the use of resources without donor‐imposed restrictions (if applicable) will also be required. Specifically, the amount, purpose, and type of board designations will be disclosed (e.g., capital replacement reserve, debt retirement reserve, contingency reserve, etc.).

Reporting investment return

Organizations will now present investment return net of related investment expenses (including both external and direct internal investment expenses) on the statement of activities. Organizations will no longer be required to disclose gross investment income and related expenses in the footnotes.

Reporting of expenses

All organizations will present expenses by both their natural classification (e.g., salaries, rent, utilities, etc.) and functional classification (program services and supporting activities). The analysis of expenses will be provided in one location, which could be on the face of the statement of activities, as a separate statement, or in the notes to the financial statements. In addition, methods used to allocate costs among program and support functions will be disclosed.

Disclosures regarding liquidity and availability of resources

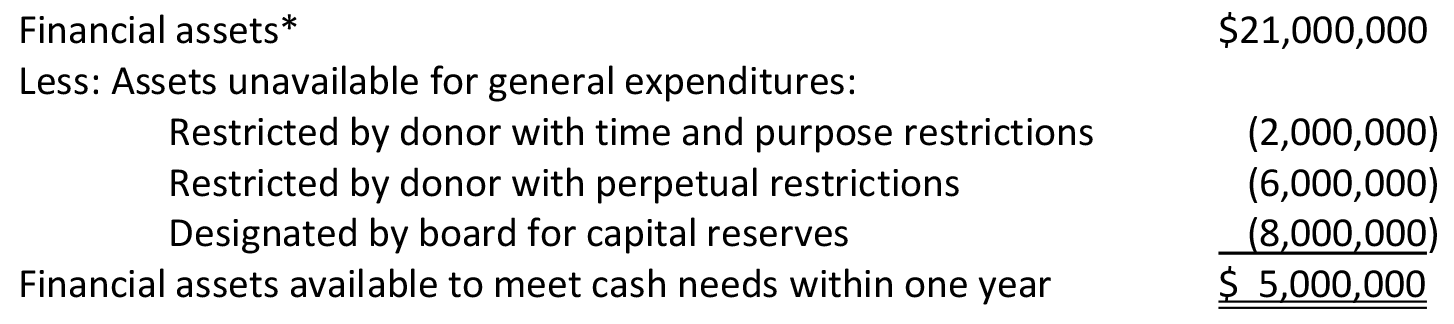

Organizations will disclose qualitative information in the footnotes that communicates how they manage liquid resources available to meet cash needs for general expenditures within one year of the date of the statement of financial position. Organizations will also include quantitative information that communicates the availability of financial assets at the date of the statement of financial position to meet cash needs for general expenditures within one year of the date of the statement of financial position. See additional discussion below.

Reporting of operating cash flows

Organizations that follow the direct method of reporting operating cash flows in the statement of cash flows will no longer be required to present or disclose the indirect method of reporting operating cash flows (this information will be optional).

The New Disclosures Regarding Liquidity and Availability of Resources

Of all the ASU’s requirements, the new disclosures regarding liquidity and availability of resources are garnering the most attention…for good reason. At the very heart of an organization’s long-term viability and sustainability is liquidity. “Liquidity” in this sense refers to an organization’s ability to use its financial assets to meet its financial obligations. Readers of nonprofit financial statements, including donors, board members, creditors, and others, often express frustration over their inability to assess the true overall liquidity of an organization based on the existing GAAP presentation model, primarily because an organization is not required to shine a light on this aspect of its financial condition. These stakeholders want to know that an organization has sufficient liquid resources to meet financial obligations as they come due. The ASU provides a higher level of transparency in this area.

There are two key elements of the new disclosure requirements – qualitative disclosures and quantitative disclosures. The qualitative disclosures provide readers with information about how the organization manages liquidity and how resources are used in carrying out the organization’s mission and purpose. The quantitative disclosures provide readers with information about the effects of external and internal limits on the use of available resources (such as donor restrictions, lending requirements, and internal board designations) to meet cash needs for general expenditures within one year of the date of the financial statements.

It is important to note that these are not forward-looking disclosures. The purpose of external financial statements is not to “predict the future.” Rather, the disclosures should be based on conditions that exist as of the date of the financial statements.

Following is an example of a quantitative disclosure and qualitative disclosure:

———

Note X – Liquidity and Availability of Resources

The following reflects the Organization’s financial assets as of the statement of financial position date, reduced by amounts not available for general use within one year of the statement of financial position date because of contractual or donor-imposed restrictions.

The Organization manages its liquid resources by employing a variety of measures. The Organization focuses on generating adequate contributions to cover the costs of its activities. In addition, the Organization invests excess cash in investments to maximize return, taking into consideration the Organization’s low tolerance for investment market risk. The Organization also monitors costs closely. As discussed in Note Y, the Organization has available a revolving line of credit with a balance up to $2 million in the event of an unanticipated liquidity need. The Organization did not use the line of credit during 20XX.

*e.g., cash, investments, and short-term receivables

———

Judgment should be exercised when preparing the liquidity and availability disclosures. For example, your organization may receive donor-restricted contributions for one or more of the organization’s ongoing and budgeted programs which will be carried out without regard to contributions restricted to that program. Should these types of donor restrictions reduce the organization’s financial assets available to meet cash needs within one year? Possibly. The ASU does not define the term “general expenditure”, so it is subject to interpretation. Differences of opinion will likely exist with regard to questions like this one, and time will tell how most organizations choose to handle such matters. We recommend that organizations consider disclosing their policy regarding what constitutes general expenditures, as well as adding clarifying language where it would be helpful with respect to any other elements of the liquidity disclosures. The qualitative disclosures present an excellent opportunity to communicate helpful information to the reader.

As is often the case, the FASB does not mandate a particular format or layout for the required disclosures. In fact, the ASU itself contains a variety of examples, each of which meets the ASU’s requirements.

Next Steps

Nonprofit organization leaders not only want their organizations’ financial statements to be accurate, they also want to ensure that the required disclosures fairly present the organization’s financial information without unintended adverse consequences. Planning ahead can help make sure these bases are covered. Following are some next steps to consider as you develop or refine your plan to address these new requirements.

• Talk with your auditor to ensure there is a clear and thorough plan to incorporate the disclosures in the financial statements. Your CPA firm may have helpful ideas regarding the content of your organization’s disclosures.

• Prepare a working draft of the required disclosures and discuss it with the organization’s other key leaders, including the board or finance committee as appropriate.

• Make a preliminary determination about whether the organization should take proactive steps to manage the information contained in the disclosures. For example, you may decide that the financial assets available to meet general expenditures are “too thin.” Consider implementing appropriate measures to maintain higher cash balances at year-end. Give thought to developing language for the qualitative disclosure to help the reader better understand your organization’s financial story.

A Final Word

Some nonprofit organization leaders are concerned that the ASU will add a substantial burden to both the internal financial team and the external auditors. Except for very unusual circumstances, that should not be the case. It is true that some additional work will be required for both the internal financial team and the external auditors. However, with good and proper planning, developing the newly required information should not be a highly burdensome process. And external auditors well-versed in this topical area should be able to assist organizations significantly by suggesting formatting for the financial statements and proposing content for the newly required disclosures. Our firm plans to assist our audit clients proactively in these areas.